GSTR 10 is a final return form which is furnished by the taxable person whose GST registration is annulled or surrendered. The GSTR 10 form has been announced by the GST council to offer cancellation of business under GST. The taxpayer can file the form and submit it to the department to get its business annulled within the ambit of the GST.

Here, we have described the proper filing guide of GSTR 10 with all the details including, step by step filing with screenshots, eligibility criteria and due date of GSTR 10.

Who is Required to File GSTR 10?

GSTR-10 is to be furnished by the persons whose registration under GST regime has been annulled or surrendered. The regular taxpayers under GST regime do not furnish the returns.

What is the Due Date for Filing GSTR 10?

GSTR 10 is required to be furnished within three months of the registration cancellation date or order cancellation date, whichever comes late. For example, if the cancellation is done on 1st August 2018, then the last date to file GSTR 10 will be 30th October 2018.

Difference Between GSTR 9 (Annual Return) & GSTR 10 (Final Return)

Annual return is to be furnished by every registered taxpayer in a normal condition under GST regime. Annual return or GSTR-9 is filed once in a year by taxpayers.

While Final return form or GSTR-10 is to be furnished by only the taxpayers whose registration has been surrendered or cancelled.

What is the Penalty for Missing the Due Date of GSTR 10?

When a taxpayer misses a due date, a notice will be sent to the address of such person. The registered person is required to file the return within 15 days of notice along with all the documents. If the person again doesn’t file the return in stipulated notice period time, the tax officer will issue the final order for the cancellation along with mentionings of the amount and interest/penalty payable.

Complete Procedure of Filing GSTR 10 Along with Screenshots:

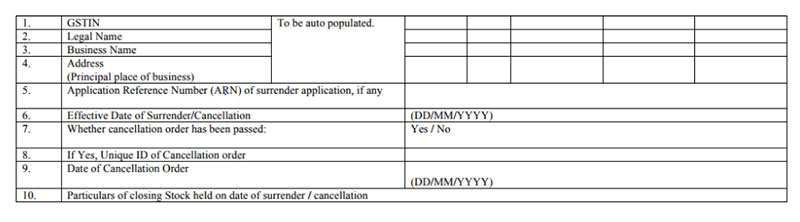

GSTR-10 is divided into 10 parts:

Here are the sections you will find auto-populated when logging into the system:

- GSTIN

- Legal Name

- Business Name

- Address

Here are the Sections Required to be Furnished by the Registered Person:

- Application Reference Number:

- ARN is required to be filed when the application for cancellation or surrender has been accepted by the higher authorities. ARN will be provided to the taxpayer when passing the cancellation order.

- Effective Date of Surrender/Cancellation:

- Here you need to fill the cancellation date of GST registration as mentioned in the order.

- Whether cancellation order has been passed:

- The taxpayer is required to mention whether the return is being furnished on behalf of cancellation order or on a voluntary basis.

- If Yes, the Unique ID of Cancellation order:

- The authority issues a Unique ID when cancelling the order of the taxpayer.

- Date of Cancellation Order:

- Here you need to fill the date of cancellation of GST registration order issued by the authorities.

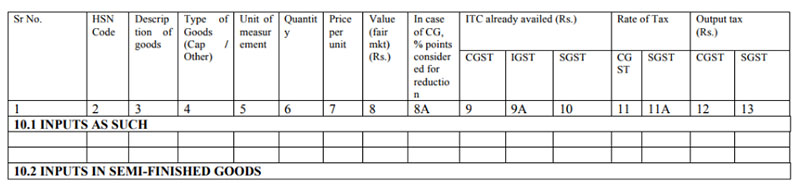

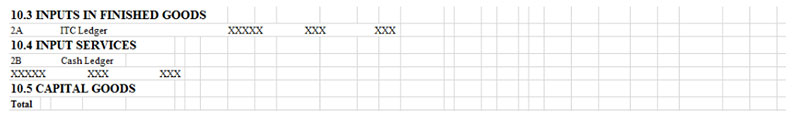

- Particulars of Closing Stock:

- The taxpayer required to file information about the closing stock when ceasing the business. The credit amount due for such stock requires being paid with the return.

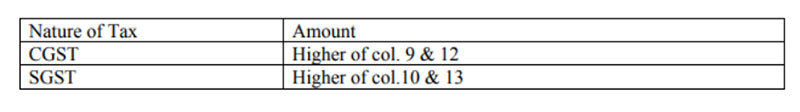

10A. Amount of Tax Payable on Closing Stock:

- This amount is auto-populated from the announcement of the amount available when closing the stock of goods.

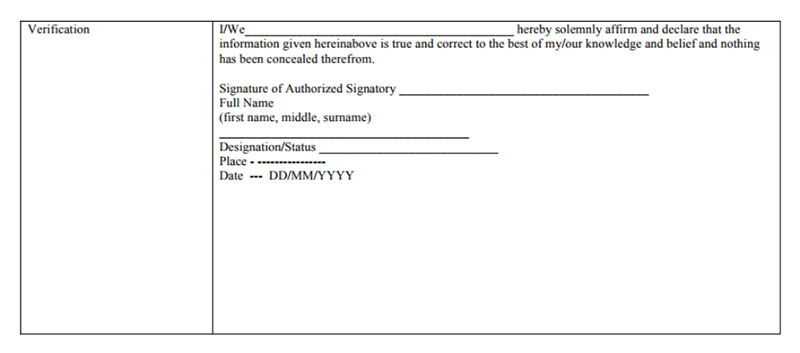

- After furnishing all the details, the taxpayer signs digitally either through Aadhaar based signature verification or a digital signature certificate (DSC) to validate the return.

No comments:

Post a Comment